Investment Recovery is “an integrated business process that identifies for redeployment or remarketing, non productive assets (surplus) generated in the normal course of business.

- Investment Recovery Association Surveys show that on average, an effective and efficient management control program will have 10% of it capital equipment surplus at any given time.

- Investment Recovery can be as single minded as managing surplus equipment or it can integrate surplus materials, chemicals, waste and finished product.

- Capital assets that become surplus to current requirements have cash flow value.

What is the opportunity / why important?

- Bring Cash to the Bottom Line : 18/1 Ratio Of Benefit To Cost

- Reduce Time to Market for Initiatives

- Eliminate Downstream Liabilities

- Reduce Cost of Future Design

- Provide Options for asset disposal

- Enhance Your Sustainability Efforts

Business Development – Key Questions

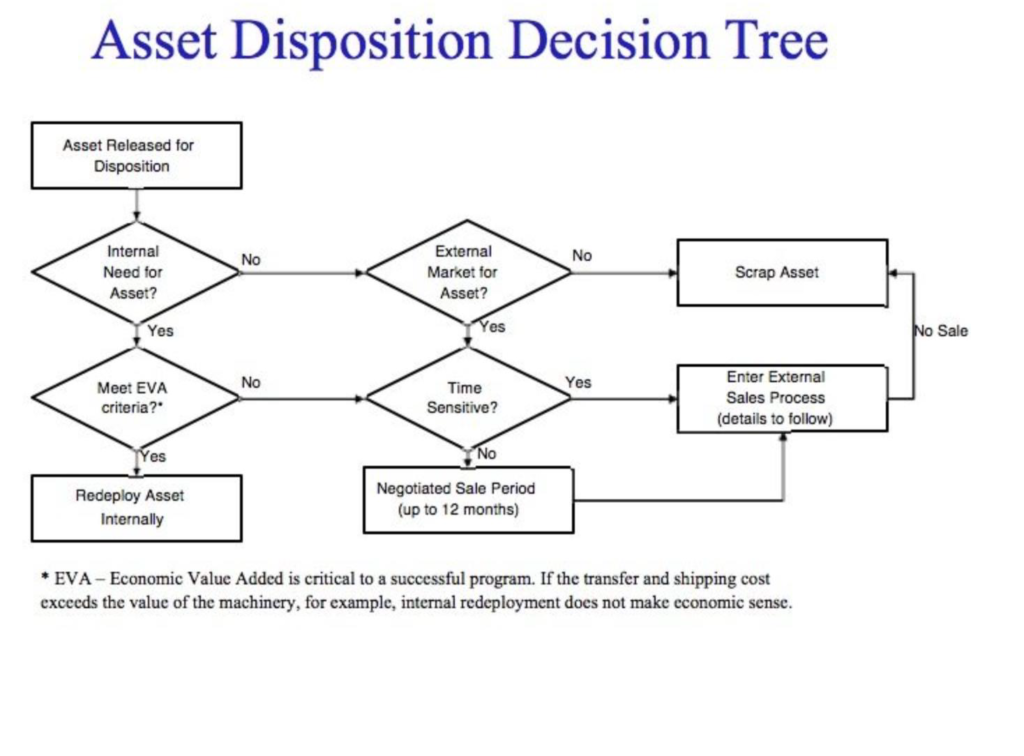

- Do you have a process of system for internal redeployment of surplus asset?

- Are you following Generally Accepted Accounting Principles as it applies to idle and surplus equipment?

- Do you have measuring tools in place to determine the effectiveness of your program?

- Do you want an internal program or does it make fiscal sense to outsource your program?

- Do you have a process or system for external sales of surplus equipment?

- Do you know where the money in going?

- Do you have an arm’s length between you and the buyer?

- Do you have an auditing process in place?

- Do you have separation of duties as it relates to the sale of surplus equipment?

- Do you have a way to track external sales?

- Who has authority to re-allocate company assets?

- Do you have the resources to effectively manage your surplus assets?

- Do you know where your surplus assets are located – on site, warehouse, external manufacturing?

- Do you know if you are getting the highest value or return on surplus?

Who are the Touch Points?

- Owner / CEO/ President / Director / Project Manager

- Finance and Accounting

- Engineering

- Purchases

- Plant Managers

- Warehouse Management

- Plant personnel

- Investment Recovery Managers

What We Do!

- The sale of surplus equipment for ongoing operations. Small jobs to large complex projects.

- General contractor to manage the critical decision points of asset recovery as a result of plant shutdowns, consolidations, mergers, acquisitions and routine ongoing operations.

- Re-marketing equipment and materials as result of demolition projects.

- Managing downstream liabilities and proprietary surplus equipment.

- Adhering to Generally Accepted Accounting Principles.

- Managing the auction process.

- Conducting plant surveys.

- Facilitating Closed Bid negotiated sales.

- Preparing reports to management to score the results.

- Providing education and benchmarking process.

- Customizing the sales approach to your specific needs.

- Managing the internal deployment of asset process.

Company Objectives

- Improve short-term cash flow

- Avoid costs associated with surplus assets

- Inventory level reduction

- Improvement of space utilization

- Partial recovery of cost of idle assets

- Strengthening of earnings through reduction in of operating costs

- Reduce liabilities

- Tax minimization

IR Professional’s Role

- Improve the company’s financial position

- Maximize return on company assets by determining the best method of disposition.

- Internally

- Externally

- Secondary sourcing

- Resource for negotiations (FMV, commissions)

- Purchaser (auctions, brokers, etc.)

Essential Skills and Knowledge

- Entrepreneurial focus

- Knowledge of the market

- Sales and marketing know-how

- Appraisal training

- Negotiation ability

- Analytical thinking

- Strong interpersonal skills

Asset Categories

- Equipment and machinery

- MRO supplies

- Obsolete / discontinued

- By-products or waste

- Raw product

- Excess inventory

- Buildings and land

Information Collection

- Identify the keeper of the information – communication is a two-way street

- Travel – field checks with key contact

- Walk around

- Talk to everyone

- Look in corners, basements, closets

- Internal documents, capital budges, disposal routings

Owner Input

- Asset location

- Original intended use

- Reason for discontinuing use

- Is it state-of-the-art or obsolete

- How much time is there of disposition

- Sales restrictions (off shore, non-competing)

- What is the owner’s assessment of

- Re-utilization

- Marketability

Investment Recovery

The Investment Recovery Association defines investment recovery as: a program to identify, reuse, sell or otherwise dispose of the surplus assets acquired through the operation of a company’s normal business.

Asset Management with Investment Recovery can:

- Provide additional source of revenue

- Improve returns on capital

- Reduce operating expense

- Reduce overhead costs

- Reduce capital costs

SUPRLUS

- Idle/excess capital and on-capital equipment

- Obsolete and excess MRO’s inventory

- Aged inventory – raw material

- Construction excess materials and equipment

- Business / plant closures

- Scrap material and waste

The Primary Objective of Investment Recover is to search out and implement the optimum method of recovery for any given surplus capital asset(s).

- Investment Recovery is “an integrated business process that identifies for redeployment or remarketing, non productive assets (surplus) generated in the normal course of business.

- Capital assets that become surplus to current requirements have cash flow value.

- Investment Recovery Association Surveys show that on average, an effective and efficient management control program will have 10% of it capital equipment surplus at any given time.

- Investment Recovery can be as single minded as managing surplus equipment or it can integrate surplus materials, chemicals, waste and finished product

Client Needs Differ

- One time disposition of known assets

- Define surplus inventory and disposition options

- Train client representative

- Draw up disposition plan for client

- Execute disposition plan for client

- Develop disposition team for client

- Develop recovery process for client

Client Engagement

- Meet with client to define needs

- Define key decision makers and criteria

- Develop contract with client for work

- Insure exclusivity for Sinfiny

- Execute plan

- Regular updates with client

- Critique the effort

- Close the project

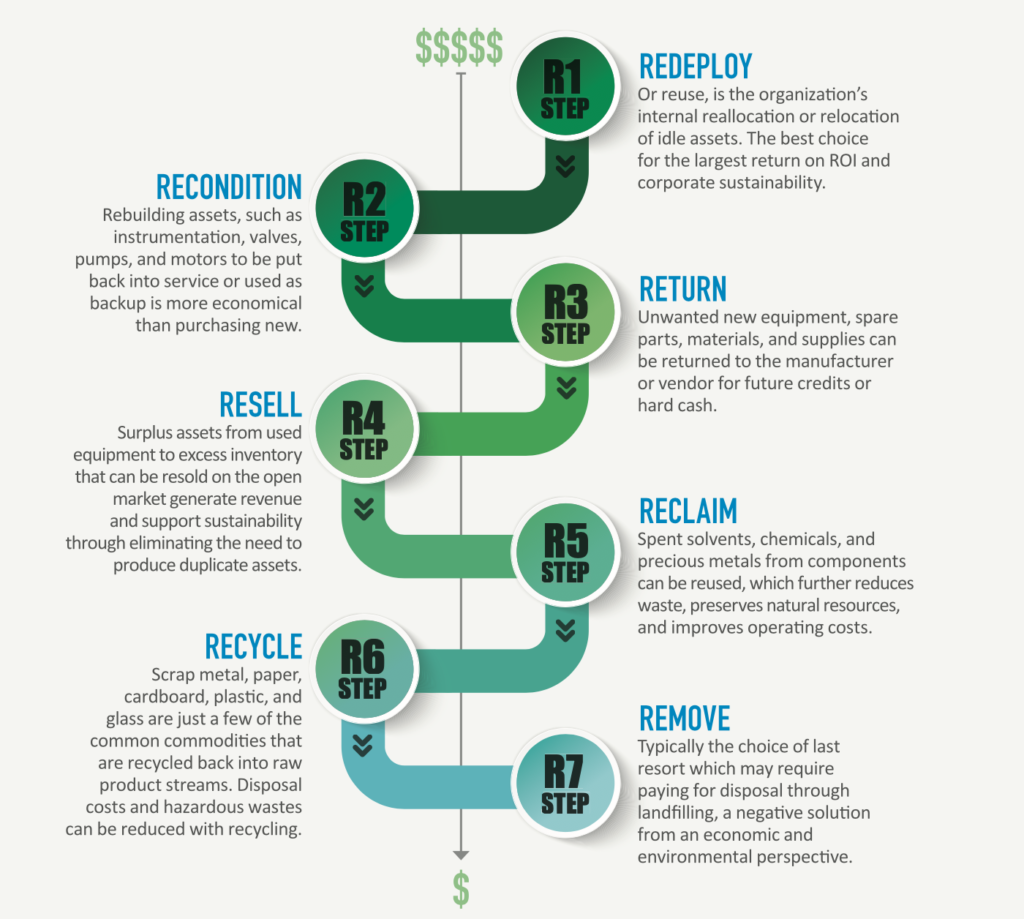

7 R’s of Investment Recovery

- REUSE– A portion of the two to five percent of idle/surplus equipment can be reused internally through investment recovery programs. In addition to keeping salvageable equipment out of the landfills, reusing existing equipment instead of purchasing new reduces capital, depreciation, taxes and insurance costs.

- RECONDITION– Rebuilding assets, such as instrumentations, valves, pumps and motors, to be put back into service or used as a backup is more economical than purchasing new. Toner printing cartridges can be rebuilt and refilled, disposable clothes and gloves reconditioned and cleaned and pallets repaired and rebuilt.

- RETURN– Unwanted new equipment, spare parts, materials and supplies can be returned to the manufacturer or vendor for future credits or hard cash.

- RESELL– As used equipment and excess inventory markets which resell unwanted idle/excess equipment become more prevalent, finding new sales outlets for old assets reduces losses and increases income.

- RECLAIM– Spent solvents and chemicals, lube and quench oils and other chemicals can be reclaimed and reused. Recovering precious metals from x-ray, photo and plating operations further reduces waste, preserves natural resources and improves operating costs.

- RECYCLE– Disposal costs and hazardous waste can be reduced with recycling. By converting oils, spent cleaning fluids and valuable chemicals, income is generated as well as resources reserved.

- REMOVE– Removing excess/idle assets lowers the tax base and increases returns on capital